montana sales tax rate 2021

Sales tax region name. Five states do not have statewide sales taxes.

Sales Tax Laws By State Ultimate Guide For Business Owners

Base State Sales Tax Rate.

. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. There is 0 additional. The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0.

You can find your sales tax rates using the below table please use the search option for faster searching. The state sales tax rate in Montana MT is currently 0. Tax rates last updated in August 2022.

Ad Lookup Sales Tax Rates For Free. Imposition and rate of sales tax and use tax -- exceptions. 2022 Montana state sales tax.

Look up 2022 sales tax rates for Rexford Montana and surrounding areas. 1 A sales tax of the following percentages is imposed on sales of the following property or services. Interactive Tax Map Unlimited Use.

The tax applies to the gross retail price. The 2022 state personal income tax brackets. B 4 on the.

Montana Sales Tax Rates 2021. The median property tax in Montana is 146500 per year for a home worth the median value of 17630000. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

The December 2020 total local sales tax rate was also 0000. Montana charges a 4 tax on medical marijuana and marijuana products sales and 20 tax on adult use marijuana and marijuana products sales. Montana Sales Tax Ranges.

Alaska Delaware Montana New Hampshire and Oregon. Local Sales Tax Range. Exact tax amount may vary for different items.

Counties in Montana collect an average of 083 of a propertys assesed fair. Income Tax Rates Deductions and Exemptions. Montana has no state sales tax and.

Tax rates are provided by Avalara and updated monthly. Before the official 2022 Montana income tax rates are released provisional 2022 tax rates are based on Montanas 2021 income tax brackets. Average Sales Tax With Local.

Look up 2022 sales tax rates for Hill County Montana. Tax rates provided by Avalara are updated monthly. Tax rates last updated in October 2022.

Sales tax region name. 2022 Montana Sales Tax Table. Combined Sales Tax Range.

Method to calculate Montana sales tax in 2022. Of these Alaska allows localities to charge local sales taxes. You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is.

The Martin City sales tax rate is NA. There is 0 additional tax districts that applies to some areas geographically within Helena. We have tried to include all the cities that come.

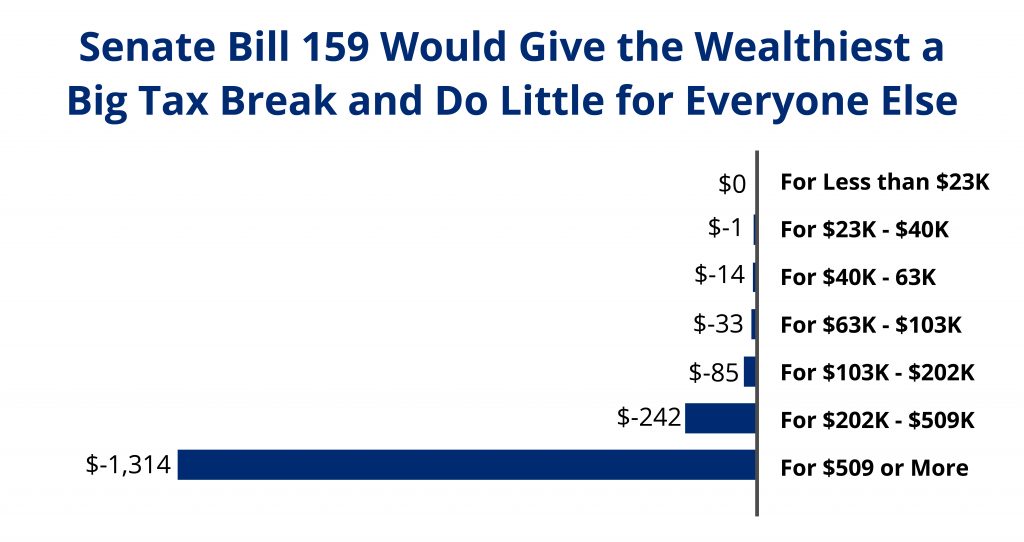

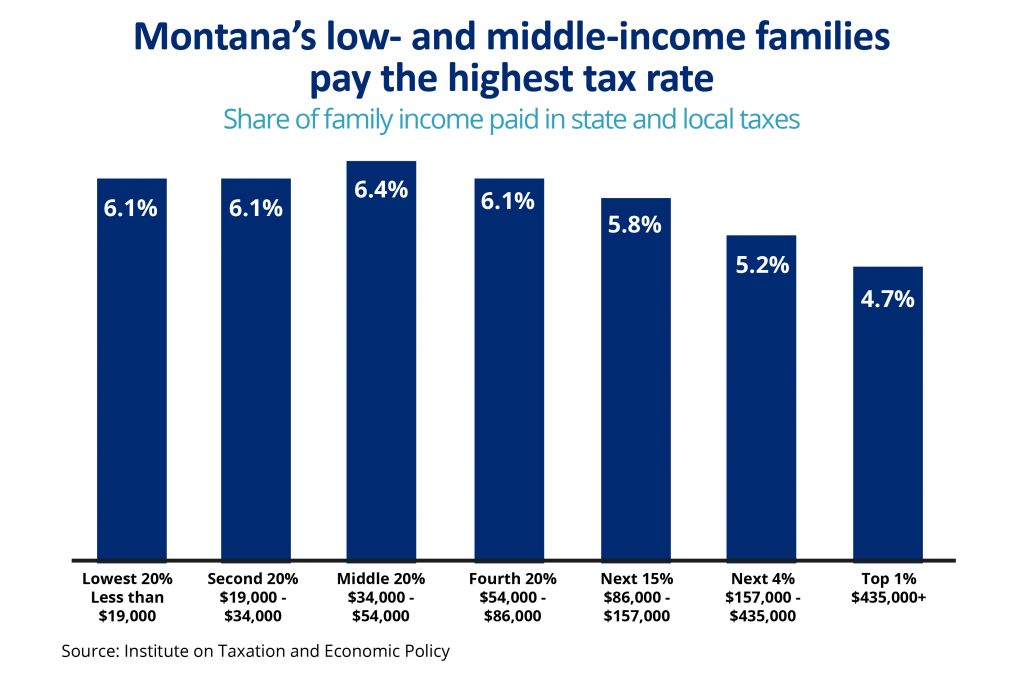

What Proposed Tax Cuts Really Mean For Montanans Montana Budget Policy Center

State Sales Tax Rates 2022 Avalara

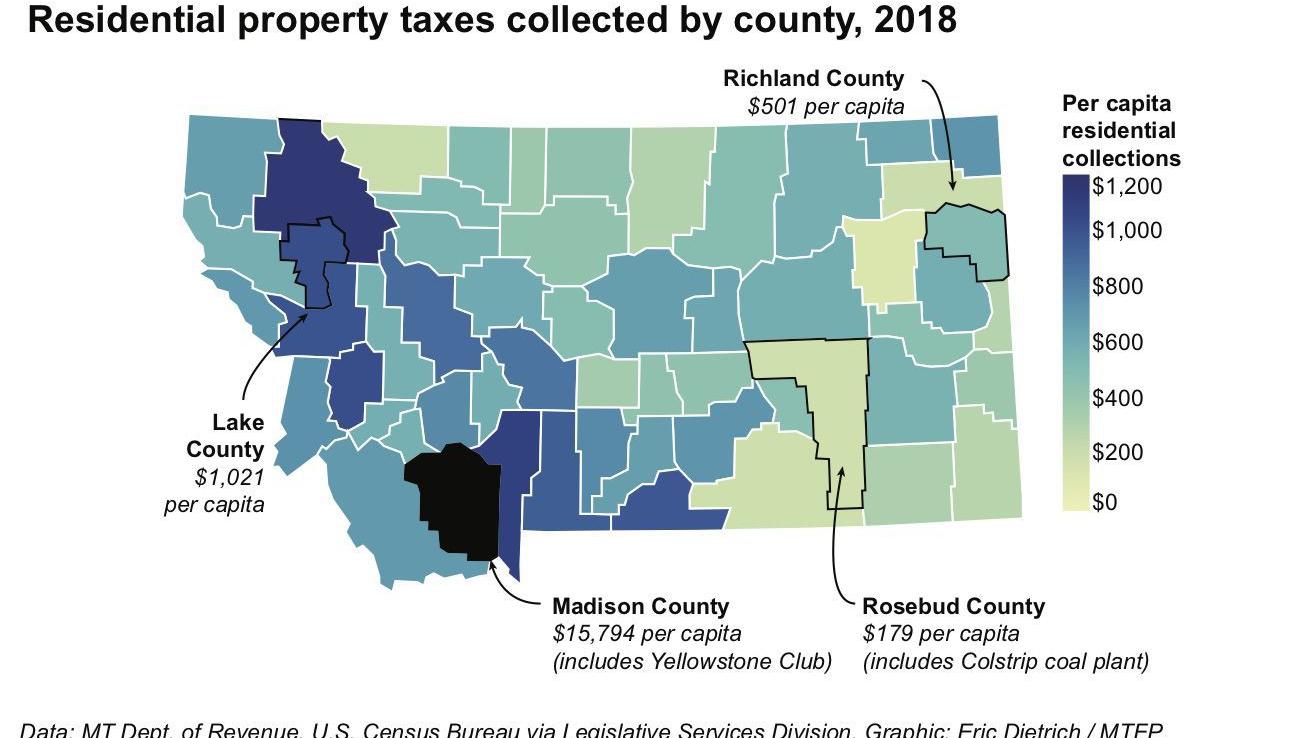

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads News Bozemandailychronicle Com

General Sales Taxes And Gross Receipts Taxes Urban Institute

Sales Tax Are All Those Receipts Worth Saving Thinkglink

.png)

State And Local Sales Tax Rates Midyear 2013 Tax Foundation

Montana State Taxes Tax Types In Montana Income Property Corporate

Sales Tax Rates Reached 10 Year High In 2020 Accounting Today

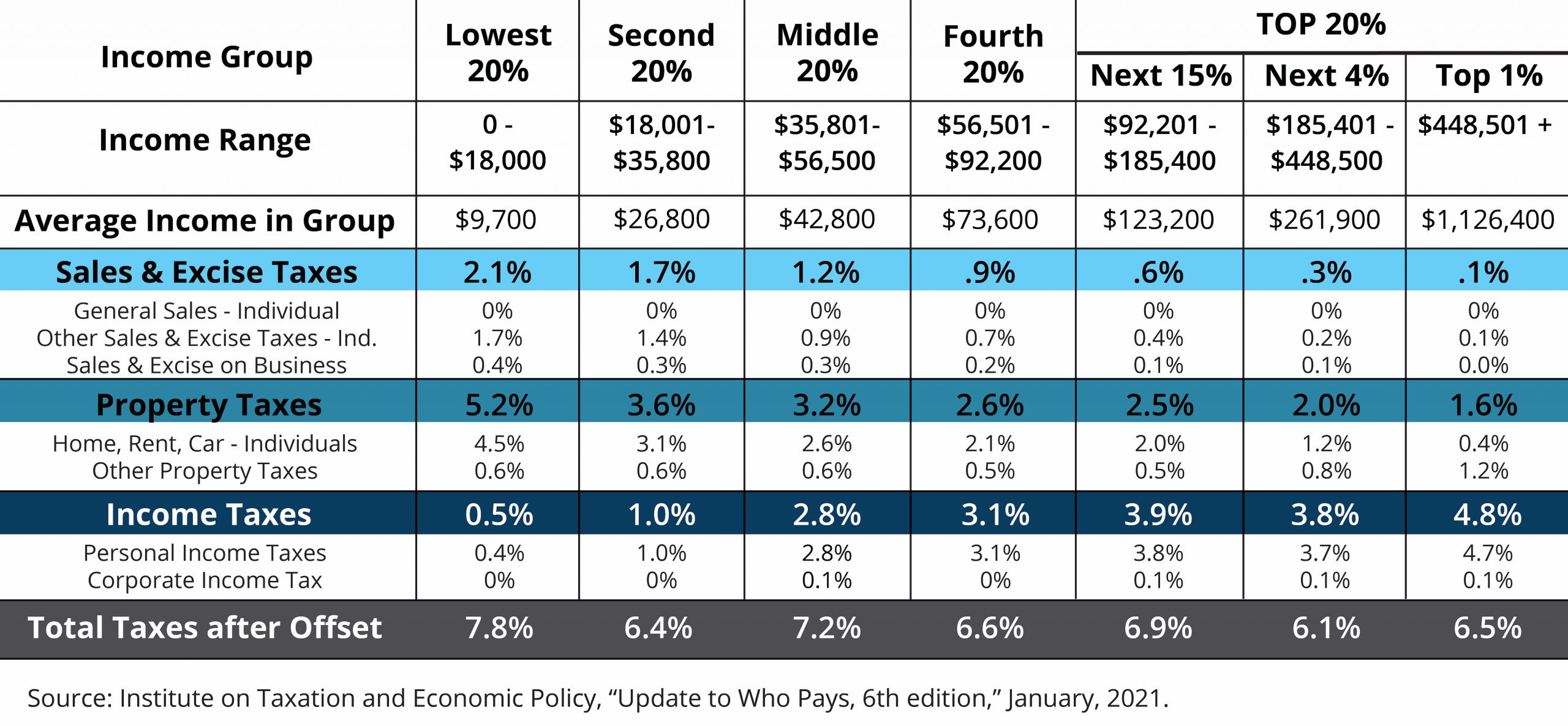

Policy Basics Who Pays Taxes In Montana Montana Budget Policy Center

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

States With The Highest Lowest Tax Rates

U S States With No Sales Tax Taxjar

Montana Income Tax Calculator Smartasset

Montana Property Taxes Keep Rising But Missoula Isn T At The Top

State Income Tax Rates And Brackets 2021 Tax Foundation

Problems With A Statewide Sales Tax Montana Needs To Help Not Hurt Families Montana Budget Policy Center

How Much Does Your State Rely On Sales Taxes Tax Foundation