how to calculate cash assets

Tighten credit to reduce the investment in accounts receivable. Subtract the amount of noncash current assets from total current assets to calculate the companys cash balance.

Financial Structure Capital Structure Capitalization And Leverage Business Risk Financial Cost Of Capital

Cash Return on Total Assets Ratio Operating Cash Flow Average Total Assets You can calculate the average total assets by summing the beginning and ending total assets and then dividing the result by 2 as follows.

. Cash flow from assets Cash flow to stockholders Cash flow to creditors 146 Cash flow to stockholders 260 Cash flow to stockholders 406. Rearranging the cash flow from assets equation we can calculate the cash flow to stockholders as. Say your current liabilities equal 8000.

Deduct the amount paid for new fixed assets from the. Current assets cash cash equivalents inventory accounts receivable marketable securities prepaid expenses other liquid assets You can usually find this information on your companys balance sheet. Write down the items purchased and amount paid just below the assets sold list.

This is a positive cash flow. How to calculate total liabilities. 24000 -10000 2000 16000.

To calculate a companys current assets you can use the following formula. Determine the after-tax cost of your donated gift. 4 Formulas to Use Cash flow Cash from operating activities - Cash from investing activities Cash from financing activities Cash flow forecast Beginning cash Projected inflows Projected outflows Operating cash flow Net income Non-cash expenses Increases in working capital.

Total Assets Liabilities Shareholder Equity read more of an organization or the firm minus its total. Long-Term Debt Excluding Current Installments. Add the three amounts to determine the cash flow from assets.

Cash Flow From Assets f - n - w Where f Operating cash flow n Net capitalspending w Changes in net working capital. Start by dividing your current assets and liabilities by the adjacent cells of B3 and B4. Tip Track a companys cash balance over time to identify any changes.

Cash is physical money and cash equivalents are assets that can easily convert to specific amounts of cash. Cut overhead to reduce operating costs. Lengthen payment intervals to suppliers.

Add up Your Assets. You will see this. In this example subtract 125000 from 200000 to get 75000 in cash.

Operating cash flow formula. Thats because the FCF formula doesnt account for. Use our non-cash assets calculator to determine the best way to donate a non-cash or illiquid asset.

Find the Cash Line Item. How Do You Calculate The Cash Ratio Using The To Calculator Cash Ratio In Excel. How to Create Positive Cash Flow.

The direction of these changes can be indicative of a companys health and. To calculate your businesss total assets you first need to know what assets you have. Use the following data for the calculation of total assets.

Check the Basic Accounting Formula. Make a Balance Sheet. How to Calculate Cash Flow.

Develop a List of Interesting Companies. So the calculation of total assets can be done as follows Total Assets Land Buildings Machinery Inventory Sundry Debtors Cash Bank Total Assets 1000000600000500000350000200000100000. How to Calculate Percentage of Cash in Total Assets 1.

A cash asset ratio below one may indicate a. Divide assets by liabilities by input. Total the amounts paid for all new fixed assets.

Total assets also equals to the sum of total liabilities and total shareholder funds. Calculating the change in assets on a companys balance sheet is an important step when analyzing a business or stock. Knowing your cash flow from operations is a must when getting an accurate overview of your cash flow.

Quick Ratio Current Assets Inventory Current Liabilities When calculating the ratio the first thing you need to do is look for each component in the current liabilities and current assets section of the balance sheet. Assets are any resources of financial. Explore these two concepts in examples of the calculations used for balancing cash.

Identify the purchases of all fixed assets. The companys cash flow from assets may indicate to buyers that purchasing the company is a good value. B3B4 and your current ratio will become apparent at.

A cash asset ratio of 1 and above indicates a company that is in good financial standing with the ability to pay off obligations through liquid assets. Cash and cash equivalents include instruments that can be converted into cash in three months or less. Plug the corresponding values into the formula and compute.

Be sure to double-check the assets youre using. Johnson Paper Companys cash flow from assets for the previous year is 16000. Cash to Current Assets Ratio Cash Cash Equivalents Marketable Securities Total Current Assets The numerator of the formula represents the value of the most liquid assets of a company.

Once you find a companys balance sheet check out the cash line item. How to Calculate Total Assets. While free cash flow gives you a good idea of the cash available to reinvest in the business it doesnt always show the most accurate picture of your normal everyday cash flow.

Average Total Assets Beginning Total Assets Ending Total Assets 2. First you need to develop a list of companies that interest you as an. Current Assets Cash Cash Equivalents Inventory Accounts Receivables Marketable Securities Prepaid Expenses Other Liquid Assets Current Assets 6000 500 1000 2000 200 2000 Your total current assets for the period are 11700.

Redesign products to reduce materials costs.

Fixed Assets Turnover Ratio Calculator Fixed Asset Financial Analysis General Knowledge

Balance Sheet Template Download Excel Worksheet Balance Sheet Balance Sheet Template Fixed Asset

How To Prepare Projected Balance Sheet Accounting Education Balance Sheet Accounting Education Accounting Principles

Financial Ratios Balance Sheet Accountingcoach Financial Ratio Accounting And Finance Accounting Education

Free Net Worth Calculator For Excel Personal Financial Statement Net Worth Statement Template

Studywalk Cash Cycle Cash Turnover Inventory Turnover Efficiency Ratios Asset Turnover Ratio Studywalk Gmail Inventory Turnover Finance Cost Accounting

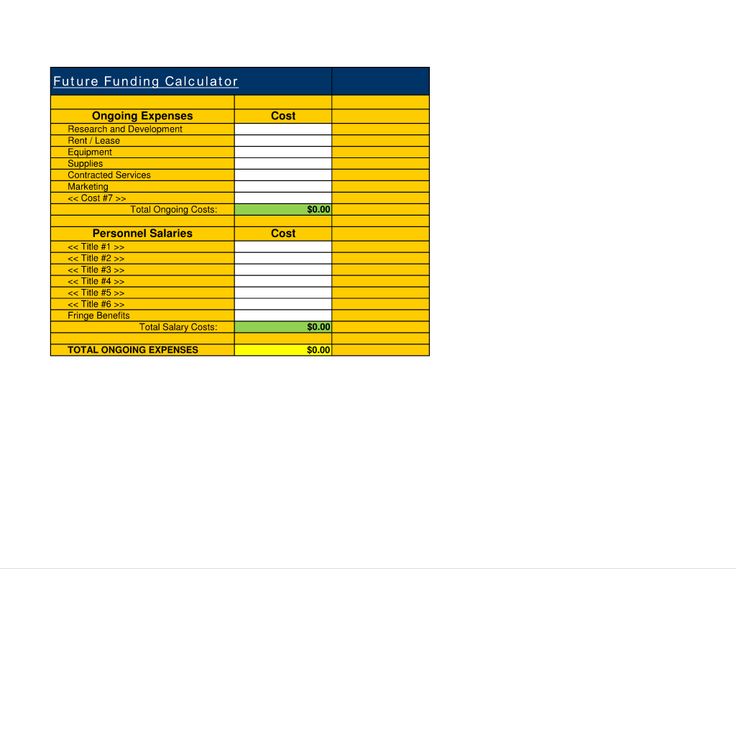

Estimate Spreadsheet Template Future Funding Calculator Spreadsheet Template Spreadsheet Cash Flow

How Balance Sheet Structure Content Reveal Financial Position Balance Sheet Balance Financial Position

How To Make A Balance Sheet For A Small Business An Easy Way To Start Is To Download This Balance Sheet Business Template Balance Sheet Template Balance Sheet

What Is My Net Worth And How Do I Calculate It Net Worth Finance Goals Investment Accounts

Capital Calculator Use The Capital Calculator To Calculate Your Working Capital Including Liquid Assets And Liabi Spreadsheet Template Calculator Spreadsheet

Cash Flow Ratios Calculator Double Entry Bookkeeping Cash Flow Statement Cash Flow Learn Accounting

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Balance Sheet For Small Business Download This Balance Sheet For Small Business Template And After Dow Balance Sheet Template Balance Sheet Business Template

Net Worth Calculator Download Xls Excel Spreadsheet Net Worth Financial Budget Financial Checklist

How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Small Business Bookkeeping

Balance Sheet Current Year Calculator Use The Balance Sheet Calculator To Calculate Spreadsheet Template Balance Sheet Template Personal Financial Statement

Business Plan Financial Calculator Projected Balance Sheet Balance Sheet Template Balance Sheet Business Template

Limited Liability Companies Statement Of Financial Position Financial Position Limited Liability Company Financial